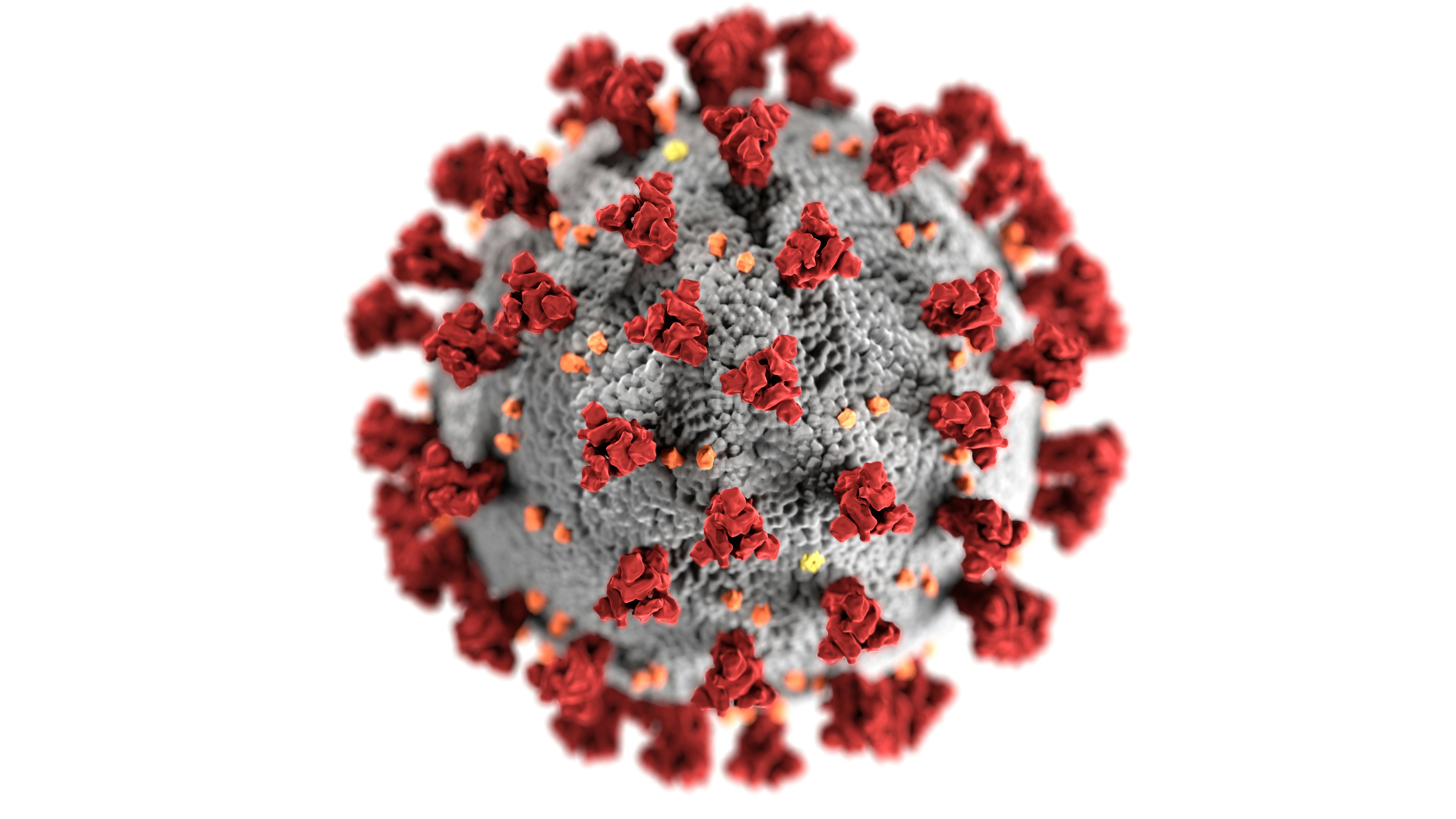

Many individuals and families may find their health and finances directly or indirectly impacted by the ongoing novel coronavirus (COVID-19) health crisis. The bill for COVID-19 hospitalizations and medical treatment can be unpredictable and vary from person to person depending on their symptoms, medical insurance, and their health status before contracting the virus. Furthermore, some people who develop the virus, as well as those who don’t, have lost their jobs and health insurance because of the economic strain caused by the pandemic.

Older adults have the highest risk for COVID-19 hospitalizations. Individuals 65 years old and up who are on Medicare may have supplemental coverage that includes most medical costs. Those who lack additional coverage, however, may face high medical bills. Patients of all ages may be experiencing challenges paying for medical expenses, as well as their monthly bills. Paying for medical costs amid the pandemic may be difficult, but it is possible with these tips.

Create a budget that will be practical amid the crisis.

People can benefit from either creating a budget if they haven’t already or changing an existing one to ensure it can withstand unexpected hardships or unpredictable financial situations caused by the health crisis. If you can trim some bills or remove them from your budget altogether, consider doing so. Temporarily ceasing some subscriptions, goods, or services allows you to free up more of your funds, which you can then put toward paying for medical treatment and supplies.

Having more funds available not only enables people to care for coronavirus-related costs, it also allows them to prioritize other aspects of their health, such as their hearing. People with the need and want to enhance their hearing health will be able to afford high-quality audiology testing. Patients can receive top-notch hearing evaluations, accurate diagnoses, and effective treatments for hearing loss and other audiology-related conditions by visiting expert audiology professionals. Getting a hearing test can allow you to diagnose any hearing problems early. That will allow you to get treatment for hearing loss early, which will slow your hearing decline. Audiologists can perform a variety of tests and help you find hearing aids if necessary. Whether the problem is with your cochlea or your eardrum, having durable medical equipment like hearing aids can help lower your out of pocket costs by mitigating the hearing decline.

Discuss existing bills and costs with your medical care provider.

Consider reaching out to your medical care provider for guidance and assistance if you’re unable to pay for medical treatment for the coronavirus and can’t take care of existing bills. Some hospitals have payment assistance programs that patients may be eligible for depending on their income or circumstances. Such programs typically adhere to federally or state-determined guidelines. Doctor’s offices and hospitals may offer payment plans in some instances that can help patients avoid experiencing more financial strain.

One cost-effective solution for financial strain during the pandemic is obtaining the medical equipment you need, such as hospital beds, nebulizers, wheelchairs, or walkers, through a reputable pharmacy that takes care of paying for medical supplies by billing Medicare on your behalf. The right pharmacy can not only submit claims to Medicare for you, but they also carry a vast selection of medical supplies in-store and conveniently deliver the medical supplies you need to you if you require such service.

Reach out to utility companies for assistance.

In addition to getting assistance for medical bills, negotiating your bills with creditors and your utility bills with utility companies is another way to solve some financial problems amid the pandemic. Contacting companies and explaining that you, like many others, have been impacted by the recent health crisis may lead to a conversation in which companies inform you of any hardship programs they may be offering. Some companies’ customer service departments may currently be helping people make arrangements in which they get the chance to make a partial payment or submit delayed payments up until a specific date. Having permission to pay bills in parts or after the due date can help some people put most of their money toward paying medical expenses for the time being.

Finances and health vary from person to person. Still, with the help of financial experts, medical professionals, pharmacies, and facilities, people can find practical ways to pay their medical expenses and take care of themselves.